Radar | Nov 30,2019

Sep 30 , 2023

By Fabio Comelli , Antonio David and Peter Kovacs

Public debt in sub-Saharan Africa has risen to levels not seen in decades, observed Fabio Comelli, a senior economist in the IMF’s African Department, where Antonio David is a deputy division chief, Luc Eyraud is chief of the regional studies division, Jimena Montoya is a senior research analyst, and Arthur Sode, an economist. Peter Kovacs, formerly of the IMF, is an economist with the European Commission. This commentary is provided by the IMF.

The average debt ratio in sub-Saharan Africa has almost doubled in just a decade - from 30pc of the GDP at the end of 2013 to nearly 60pc by the end of last year. Repaying this debt has also become much costlier.

The region’s ratio of interest payments to revenue, a key metric to assess debt servicing capacity and predict the risk of a fiscal crisis, has more than doubled since the early 2010s; it is now close to four times the ratio in advanced economies. The International Monetary Fund (IMF) assessed more than half of the low-income countries in sub-Saharan Africa to be at high risk as of 2022, or already in debt distress.

These trends have sparked concerns of a looming debt crisis in the region.

A recent IMF paper offers possible solutions to prevent this from happening. It identified five policy actions African governments can take to preserve the sustainability of public finances, while also achieving the region’s development goals.

In most sub-Saharan African countries, fiscal policy focuses excessively on short-term goals. It is not guided by a clear medium-term strategy. This lack of anchoring has resulted in frequent breaches of fiscal rules and ever-increasing public debt levels.

A more strategic approach to fiscal policy would be preferable by setting explicit debt targets that integrate key policy trade-offs between debt sustainability and development objectives, rather than focusing narrowly on short-term fiscal deficits. The paper suggests a novel approach to estimating country-specific medium-term debt anchors, which ensures that debt service costs remain manageable.

According to this methodology, the median debt anchor for the region is about 55pc of the GDP; slightly more than half of the countries were above their anchor at end-2022.

The IMF staff analysis shows that most countries in the region will need to reduce their fiscal deficits in the coming years. For the average country, the amount of adjustment is about two to three per cent of GDP.

This adjustment seems feasible given historical experience - in the past, countries in sub-Saharan African countries improved their primary balance by one per cent of GDP a year over two to three years.

But not all countries face the same challenge. About a quarter of the region’s economies still have some fiscal space and can use it to maintain and even increase vital investments in human and physical capital. On the other hand, a few countries have very large adjustment needs; for them, it is unlikely that fiscal consolidation alone will be enough to ensure fiscal sustainability. It may need to be complemented by debt reprofiling or restructuring.

Sub-Saharan African countries tend to rely excessively on expenditure cuts to reduce their fiscal deficits. Although this may be warranted in some circumstances, revenue measures, like eliminating tax exemptions or digitalising filing and payment systems, should play a greater role. Mobilising domestic revenue is less detrimental to growth in countries where initial tax levels are low, whereas the cost associated with reducing expenditures is particularly high given Africa’s large development needs.

While difficult to achieve, large and rapid increases in revenue have been observed in some countries like The Gambia, Rwanda, Senegal, and Uganda, which relied on a mix of revenue administration and tax policy measures.

Policy changes are more likely to yield tangible results if fiscal institutions are strong and efficient. On the expenditure side, well-designed plans too often yield disappointing results due to budgetary slippages or an unforeseen materialisation of fiscal risks. Adopting a medium-term fiscal framework, putting in place tools to better assess and manage fiscal risks, and enhancing controls over government expenditure during the budget implementation phase are key to avoiding such pitfalls.

Strong expenditure controls - by strengthening the legal budgeting framework, improving fiscal reporting, and empowering audit and control institutions - are particularly important, as they help countries avoid budgetary slippages, as well as decrease the risk of extra-budgetary commitments, which are widespread in the region.

The sustainability of a new fiscal strategy also depends on the government’s ability to secure public support by linking the policy measures to longer-term benefits. Public acceptance should be a central consideration in policy design - for instance, by sequencing reforms carefully and introducing compensatory measures.

Communication campaigns that transparently and credibly outline the long-term benefits of the reform, its distributional consequences, and the costs of inaction are also critical. Public acceptance of reforms depends more generally on the ability of governments to convince the population that they will use public funds in an efficient, fair, and transparent manner.

PUBLISHED ON

Sep 30,2023 [ VOL

24 , NO

1222]

Radar | Nov 30,2019

Radar | Aug 21,2021

Viewpoints | May 18,2024

Commentaries | Oct 03,2024

Advertorials | Sep 13,2021

Commentaries | Jan 04,2020

Sunday with Eden | Oct 31,2020

Radar | Aug 06,2022

View From Arada | Apr 20,2025

Editorial | Jun 12,2021

My Opinion | 128690 Views | Aug 14,2021

My Opinion | 124938 Views | Aug 21,2021

My Opinion | 123020 Views | Sep 10,2021

My Opinion | 120834 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

May 3 , 2025

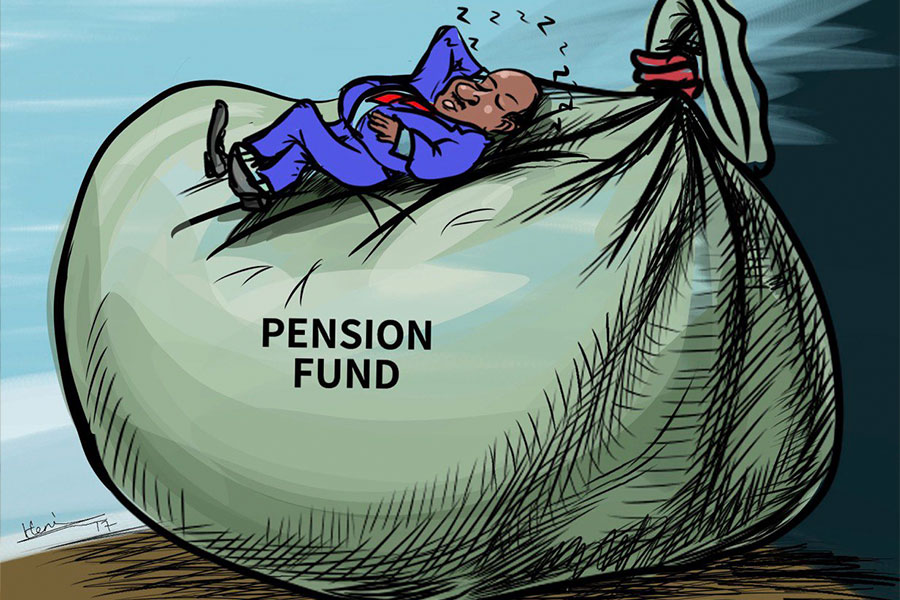

Pensioners have learned, rather painfully, the gulf between a figure on a passbook an...

Apr 26 , 2025

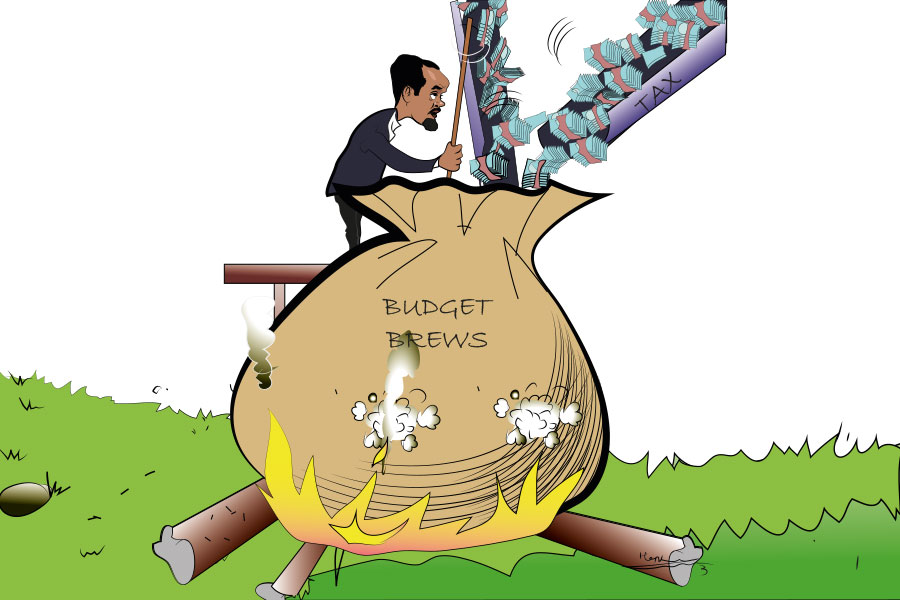

Benjamin Franklin famously quipped that “nothing is certain but death and taxes.�...

Apr 20 , 2025

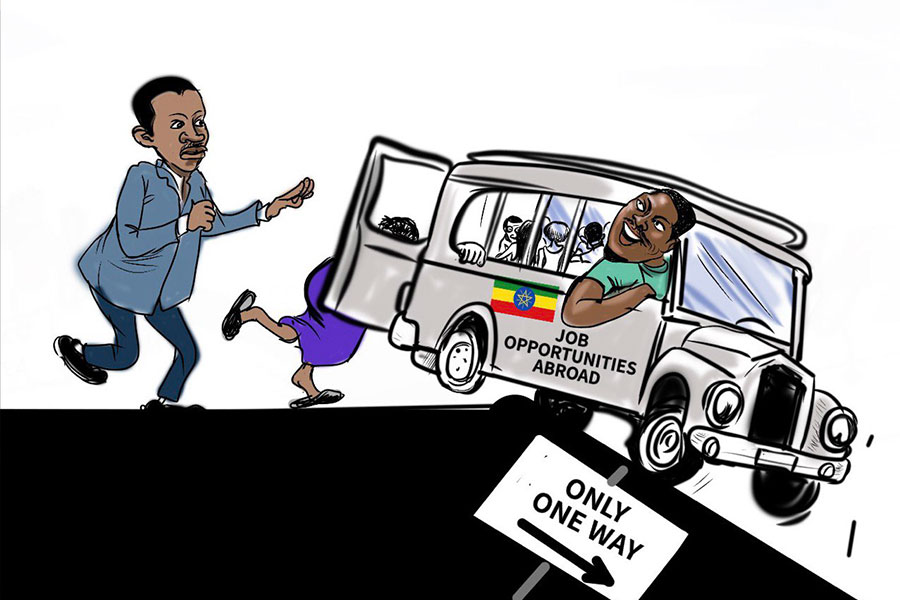

Mufariat Kamil, the minister of Labour & Skills, recently told Parliament that he...

Apr 13 , 2025

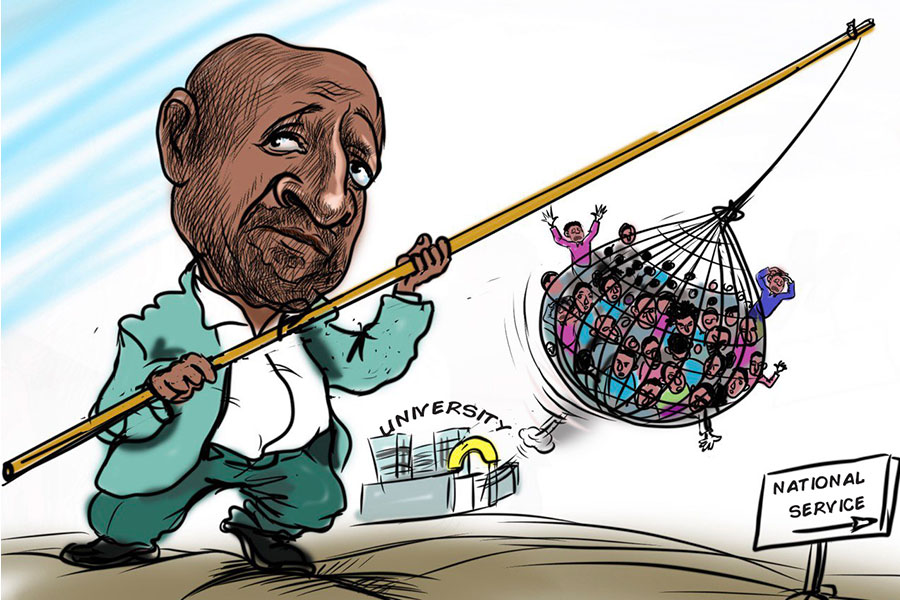

The federal government will soon require one year of national service from university...

May 3 , 2025

Oromia International Bank introduced a new digital fuel-payment app, "Milkii," allowi...

May 4 , 2025 . By AKSAH ITALO

Key Takeaways: Banks face new capital rules complying with Basel II/III intern...

May 4 , 2025

Pensioners face harsh economic realities, their retirement payments swiftly eroded by inflation and spiralling living costs. They struggle d...

May 7 , 2025

Key Takeaways Ethiopost's new document drafting services, initiated in partnership with DARS, aspir...